Gartner has released the 2020 Magic Quadrant for RPA.

Let us have a quick look at the most interesting tidbits from the report.

Key takeaways

Here are my three main takeaways:

- The bigger players are here – Microsoft, SAP and Samsung SDS – and is a pointer of things to come. Next year, we should see IBM also added with their recent WDG acquisition.

- The most visionary RPA companies are not necessarily the top 4– they are Microsoft and Pega. Among the top four, Automation Anywhere is the most visionary.

- The ten largest RPA software vendors account for over 70% of market share in the RPA market. The top 3 account for 50% of the market share.

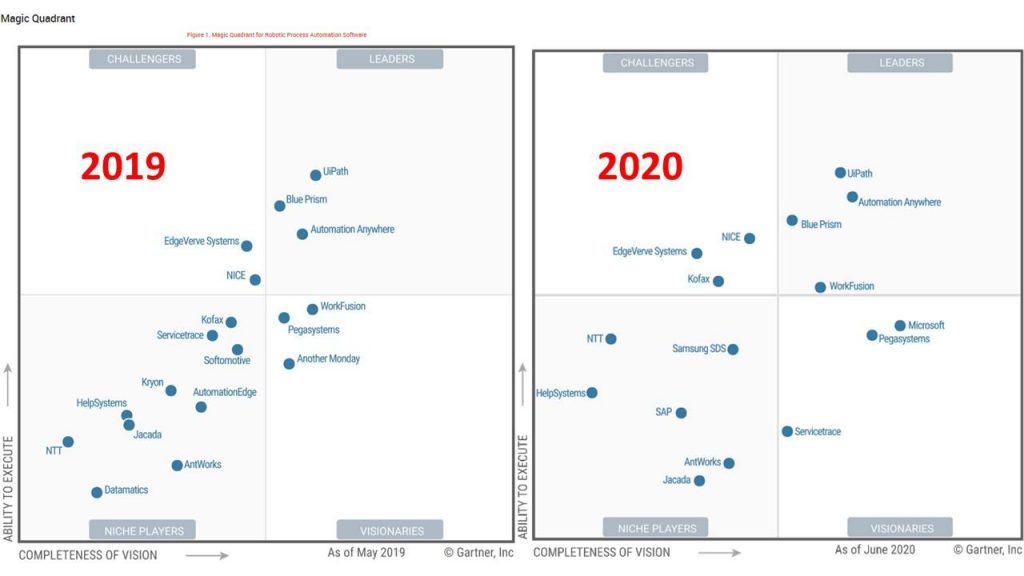

Comparison to previous Quadrant

It is interesting to see how things have evolved since Gartner released their first quadrant last year. Here are three interesting finds:

- Workfusion edged into the leader quadrant this time and so we have top 4. Microsoft looks poised to enter the leader quadrant once they execute on the Softomotive acquisition.

- Microsoft, SAP and Samsung SDS are new this year. Samsung SDS is an interesting and comparatively lesser known player with operations in Asia/Pacific countries including China, South Korea, India and Vietnam, and it plans to expand into North America and EMEA.

- Five players dropped out entirely – Another Monday, AutomationEdge, Datamatics, Kryon and Softomotive (acquired by Microsoft)

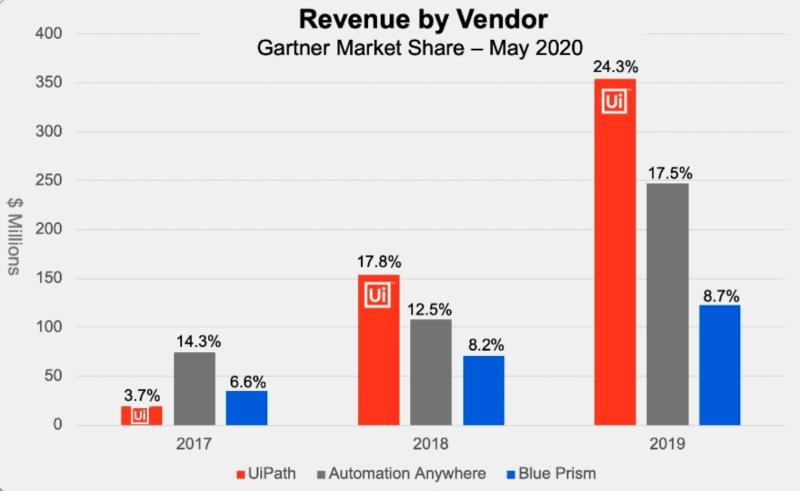

RPA vendor market share

As I said in the top takeaways, 50% of the market share is with the top 3. This is based on a chart that Gartner released showing the revenue and Market share of the Top 3. Some interesting observations:

- UiPath grew from 4% to 24% market share in 2 years (#3 to #1 by a wide margin)

- The total market share of the top 3 is 50% (Winner takes all)

- The market share of Blueprism and AA have not changed much over the last 3 years (revenues have grown)

Uipath went from third to top of the charts in a year and has been consolidating since. It is amazing how things can change in such a brief time. We can expect to see tremendous changes in the next few years as well with the big tech starting with Microsoft getting involved in the space.

Vendor Road maps

It was also interesting to see the Road maps of different RPA players. Here are few interesting things to look forward to:

- Microsoft: RPA, AI on Cloud along with broad tech capabilities, Softomotive integration, Open-source RPA standard on Azure Marketplace with Robin?

- Automation Anywhere: Bot agents in Linux and MacOS, Conversational AI

- Blue Prism: On-demand scaling capabilities for RPA, Self-correction of process automation

- Pega: Process Fabric — a completely serverless and distributed process management solution.

- UiPath: low-code business apps (studioX?), expanding Automation Cloud with robots as a service

- SAP: Cloud Applications Studio features, Strong focus on citizen developer enablement and reuse.

- EdgeVerve: Internet of Things (IoT) integration, message-based bot communication

- Nice: New cloud optimized architecture, direct click-to-automate feature, and AI-driven guided navigation

The RPA space is evolving rapidly, and we will only see more changes on the next Magic Quadrant if there is one. There are rumors that the RPA category may be replaced. Gartner has been touting “Hyperautomation” and we will have to wait and see how the space and Gartner’s analysis evolves.